All Categories

Featured

That's not the exact same as spending. They will certainly not just desire you to get the product, they desire you to go into organization with them, join their team. Ask on your own, has this individual that's offering this product to me been doing this for 5 years or at least 10 thousand hours' well worth of solutions?

I want you to be a professional, a master of all the understanding needed to be a success. Do not, Manny, if you do this, do not call a good friend or family for the very first five years. And after that, incidentally, you wish to inquire that in the meeting.

Iul Death Benefit

I suggest, that's when I was twenty-something-year-old Brian being in his money class, and I was looking about, going, 'What do these people do after they finish?' And all of them go benefit broker-dealers or insurance provider, and they're offering insurance. I relocated over to public accountancy, and now I'm all thrilled due to the fact that every moms and dad is usually a certified public accountant that has a youngster in this evening.

That's where knowledge, that's where understanding, that's where proficiency comes from, not even if somebody likes you, and currently you're gon na go turn them into a client. For more details, inspect out our complimentary resources.

I indicate, I am an economic solutions professional that reduced her teeth on entire life, however that would certainly embrace this concept centered around acquiring only term life insurance coverage? Granted, term is an affordable type of life insurance policy, but it is likewise a short-term type of insurance coverage (10, 20, 30 years max!).

It guarantees that you have life insurance policy beyond thirty years no issue how much time you live, in truth and depending on the kind of insurance, your premium amount may never change (unlike renewable term policies). Then there is that entire "spend the distinction" thing. It truly massages me the upside-down.

:max_bytes(150000):strip_icc()/Pros-and-cons-indexed-universal-life-insurance_final-1b83c0fd52154eb69edd47f99ab8927a.png)

Maintain it genuine. If for nothing else factor than the reality that Americans are horrible at saving cash, "buy term and invest the distinction" should be outlawed from our vocabularies. Hold your horses while I go down some understanding on this point: According to the U.S. Social Protection Administration, the average American's annual wage was $42,979.61 in 2011; Yet, only 14.6 percent of American households had liquid properties of $50,000 or more throughout that exact same period; That indicates that less than 1 in 4 households would be able to replace one income-earner's earnings should they be out of work for a year.

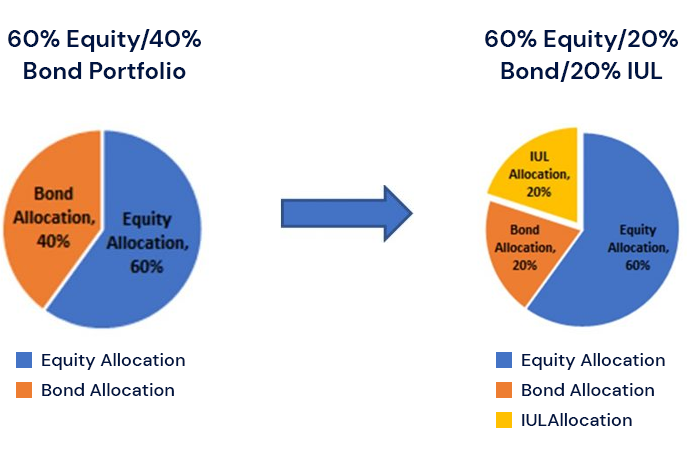

What if I told you that there was a product that could assist Americans to get term and invest the distinction, all with a solitary purchase? Right here is where I get simply downright bizarre. Watch closelyHave you ever researched exactly how indexed universal life (IUL) insurance practically functions? It is a type of cash money worth life insurance that has an adaptable premium repayment system where you can pay as much as you want to develop up the cash money worth of your policy faster (subject to certain limits DEFRA, MEC, TEFRA, and so on). what is better term or universal life insurance.

Latest Posts

Insurance Indexing

Iul Life Insurance Canada

Does Universal Life Insurance Expire